Following an unusually severe winter that stagnated much economic activity, small and mid-sized business owners in the U.S. are now forecasting sunnier days ahead, at least for the next six months.

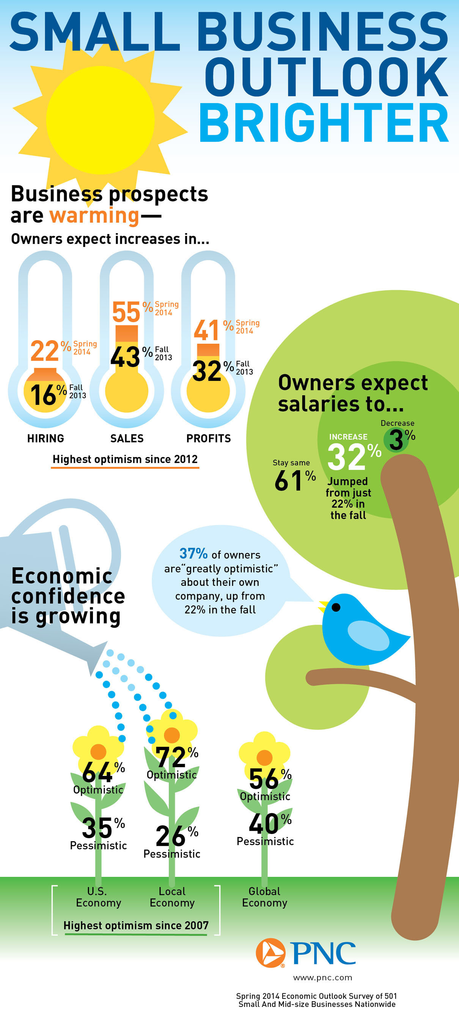

That's according to the latest findings of the PNC Economic Outlook survey, which found that 55 percent anticipate rising sales revenue and 41 percent expect higher profits. Both are the highest since PNC's 2012 survey.

On hiring, 22 percent of respondents expect to add full-time employees in that time frame. That is a six percentage point increase from last spring and also the most since 2012.

The spring findings of PNC's biannual survey, which began in 2003, reveal that nearly four in 10 (37 percent) owners are strongly optimistic about their near-term business prospects, while the 12 percent who are pessimistic is the fewest since 2007.

Positive attitudes towards their own business prospects are matched by increased optimism towards the U.S. economy as well. The number of owners who report feeling “greatly optimistic” about the U.S. economy nearly doubled from seven percent to 13 percent since fall while those who are at least “moderately optimistic” is 64 percent, the most since 2007, pre-recession.

“The harsh winter's impact on the U.S. economy overall appears to be temporary,” said Stuart Hoffman, chief economist at PNC. “Now, pent-up consumer demand and continued support from the Federal Reserve are fueling the upbeat tone. These findings support our baseline forecast that the U.S. economic and jobs expansion should quickly bounce back this spring and propel what should be the economy's best year since before the Great Recession.”

Survey results also indicate more pay raises are expected. Thirty-two percent of owners expect to increase employee wages over the next six months, a sharp 10 percentage point increase since fall.

With a mix of salaried and hourly employees, seven in 10 owners say a potential federal minimum wage increase would not impact 2014 hiring plans. In contrast, one in four (26 percent) say they would reduce hiring with just a few of those owners (six percent) who would cut existing employees as a result of such an increase.

Other key findings include:

- Price Hikes Carry Minimal Impact: Nearly 40 percent plan to raise prices, and largely only intend to do so by 1-2 percent, below the Federal Reserve's two percent inflation goal.

- Need for Loans Decreases: Only 15 percent will probably or definitely take out a new loan or line of credit in the next six months, a five percentage point decline since fall 2013. While fewer plan to borrow, credit availability continues to improve, as the gap has narrowed between those who say credit is easier to obtain (17 percent) versus more difficult (18 percent).

- Housing Rebound Slows: 48 percent expect home prices in their local market to rise in the coming year, down 10 percentage points from the fall survey. Expectations of price declines held steady at just seven percent of respondents.

The PNC Financial Services Group, Inc. (www.pnc.com) is one of the nation's largest diversified financial services organizations providing retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management.

Methodology

The PNC Economic Outlook survey was conducted between Jan. 21 to Feb. 14, 2014, by telephone within the United States among 1,100 owners or senior decision-makers of small and mid-sized businesses with annual revenues of $100,000 to $250 million. The results given in this release are based on interviews with 501 businesses nationally, while the remaining interviews were conducted among businesses within the states of Alabama, Florida, Georgia, Illinois, Indiana, Michigan, North Carolina, Ohio and Pennsylvania plus Washington, D.C.

Sampling error for the national results is +/- 4.4 percent at the 95 percent confidence level. The survey was conducted by Artemis Strategy Group (www.ArtemisSG.com), a communications strategy research firm specializing in brand positioning and policy issues. The firm, headquartered in Washington D.C., provides communications research and consulting to a range of public and private sector clients.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Small Business, Staffing